Add this to the dallas mta tax at01 and the state sales tax of0625 combined together give you a tax rate of0825. Spv applies wherever you buy the vehicle in texas or out of state.

Some dealerships may charge a documentary fee of 125 dollars.

Car sale tax in texas. The state of texas imposes a motor vehicle sales and use tax of 625 of the purchase price on new vehicles and 80 of the standard presumptive value non dealer sales of used vehicles. Find your states vehicle tax tag fees when purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. Whether or not you have a trade in.

New texas residents pay a flat 9000 tax on each vehicle whether leased or owned when they establish a texas residence. Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive value spv whichever is the highest value. If you are buying a car for 2500000 multiply by 1 and then multiply by0825.

In addition to taxes car purchases in texas may be subject to other fees like registration title and plate fees. Spouse parent or stepparent grandparent or grandchild child or stepchild sibling guardian decedents estate or a non profit 501 c 3. Buying or selling a vehicle.

The type of license plates requested. You are going to pay 206250 in taxes on this vehicle. The tax is a debt of the purchaser until paid to the dealer.

Sales tax according to the texas department of motor vehicles car owners must pay a motor vehicle tax of 625 percent. The maximum tax that can be charged is 575 dollars. A 10 gift tax applies to a person who receives the vehicle from a.

New car sales tax or used car sales tax. The state in which you live. The dealer will collect motor vehicle sales tax from the purchaser when a motor vehicle is purchased from a dealer in texas if the motor vehicle has a gross weight of 11000 pounds or less.

Texas collects a 625 state sales tax rate on the purchase of all vehicles. To calculate the sales tax on a vehicle purchased from a dealership multiply the vehicle purchase price by 625 percent 00625. This is not including the tags and license fees.

The county the vehicle is registered in. The dealer will remit the tax to the county tax assessor collector.

Free Harris County Texas Motor Vehicle Bill Of Sale Mv

Free Harris County Texas Motor Vehicle Bill Of Sale Mv

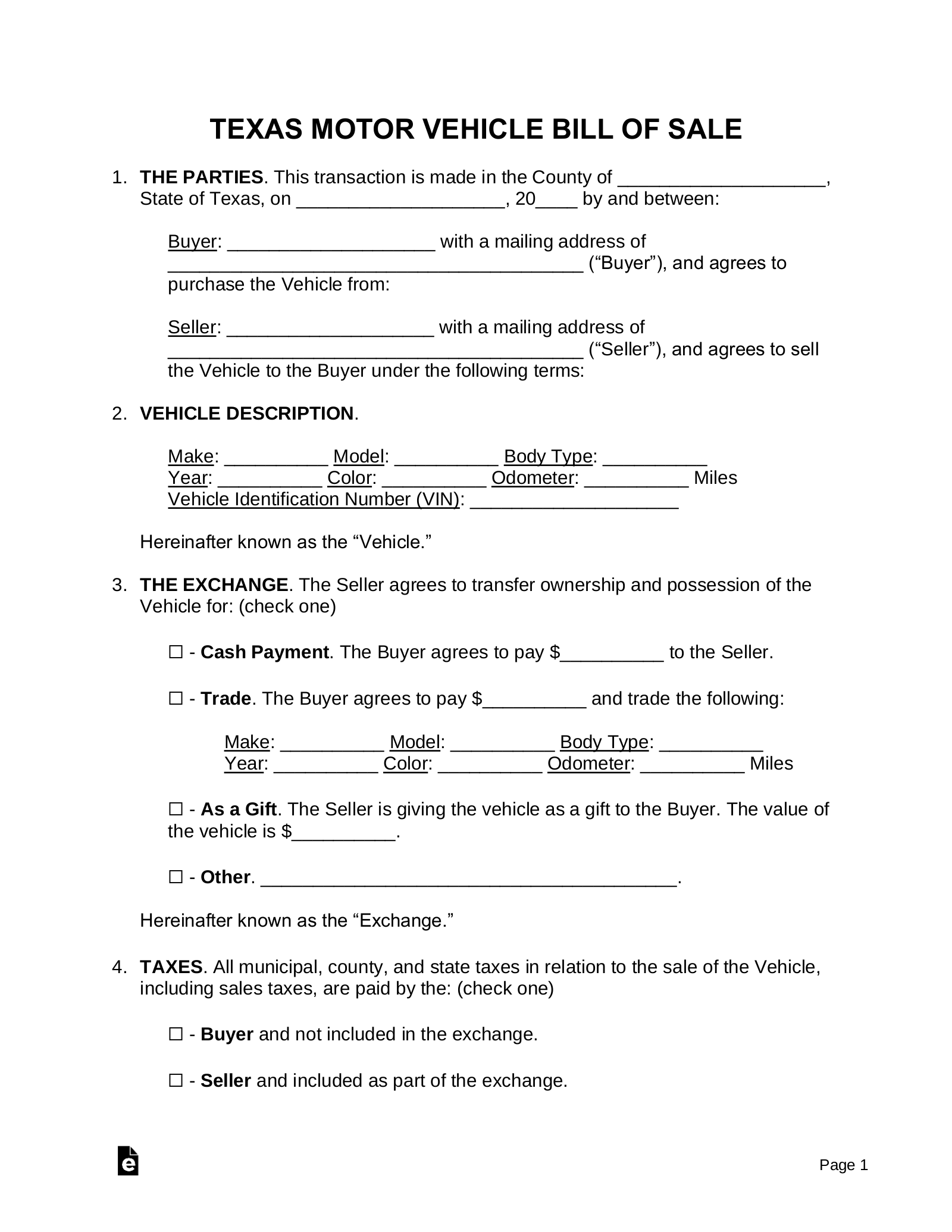

Free Texas Motor Vehicle Bill Of Sale Form Pdf Eforms

Free Texas Motor Vehicle Bill Of Sale Form Pdf Eforms

State Sales Tax State Sales Tax Used Car

State Sales Tax State Sales Tax Used Car

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Motor Vehicle Sales Tax In Texas Avalara

Motor Vehicle Sales Tax In Texas Avalara

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Texas Tax Exempt Form Agricultural Sales For Motor Vehicle

Fillable Online Window State Tx 14 115 Motor Vehicle Sale

Fillable Online Window State Tx 14 115 Motor Vehicle Sale

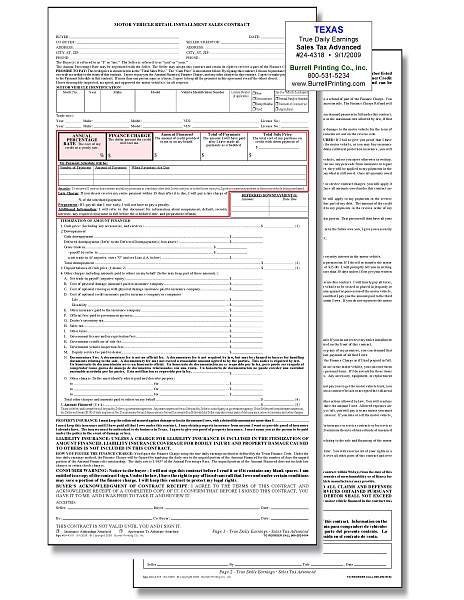

Burrell Printing Company Inc Our Products Auto Dealers

Burrell Printing Company Inc Our Products Auto Dealers