Determine the net purchase price of your vehicle. If the sales or use tax is not paid on time the buyer will have to pay interest and penalties.

Understanding Taxes When Buying And Selling A Car Cargurus

Understanding Taxes When Buying And Selling A Car Cargurus

Find out the auto sales tax rate specific to your state and city.

Car sale tax. Exceptions if one of the following exceptions applies the tax due is 15. The dealer will collect motor vehicle sales tax from the purchaser when a motor vehicle is purchased from a dealer in texas if the motor vehicle has a gross weight of 11000 pounds or less. Whether or not you have a trade in.

The vehicle is being transferred in a business reorganization. A motor vehicle is any vehicle that requires a license for road use such as. If the sale is made by a motor vehicle dealer or lessor who is registered the sales tax rate is 625.

The values provided are estimates for illustration purposes only and are based where applicable on the information you enter. The tax is a debt of the purchaser until paid to the dealer. The sales tax applies to transfers of title or possession through retail sales by registered dealers or lessors while doing business.

The dealer will remit the tax to the county tax assessor collector. Multiply the net price of your vehicle by the sales tax percentage. Within states that have different car tax rates for different cities you pay the car tax rate based on your home address.

The county the vehicle is registered in. The vehicle is an estate gift to a beneficiary other than a surviving spouse. Tax title and tags vary by state and will be calculated at the time of purchase.

Motor vehicle sales tax is due on most motor vehicle purchases or transfers. Used car sales tax similar to how they can help you with dmv related fees dealerships can also help you figure out your used car sales tax. Because sales tax is a percentage it raises with the value of your purchase.

The vehicle is being transferred. Car tax is paid based on the state where the car is first registered so if you live in california and buy a car in oregon you will have to pay when you register the car back in your home state. This is due in large part to the newer condition of most pre owned vehicles.

However if you purchase your used car from a private party youll have to handle this step on your own. Tax is due every time that a title transfers unless an exemption applies. The vehicle is an estate gift to a surviving spouse including a party to a civil union.

The state in which you live. Aprs and terms used in estimates may not be applicable based on vehicle and state of purchase. For comparison you may spend around 34000 on a brand new vehicle.

Find your states vehicle tax tag fees when purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. The average cost of a used car in todays market is just under 20000. If you prefer to determine this cost in advance youll want to take the following steps.

This includes sales by car dealers leasing companies private individuals or any other type of business. New car sales tax or used car sales tax. Motor vehicle sales or use tax is due by the 20th day of the month following the purchase use storage or any other consumption within massachusetts.

The type of license plates requested.

Taxes Charged On Car Rental Bill Are They Sales Taxes

Taxes Charged On Car Rental Bill Are They Sales Taxes

Understanding Taxes When Buying And Selling A Car Cargurus

Understanding Taxes When Buying And Selling A Car Cargurus

Car Purchase Tax Deduction For Personal Vehicles Otacademy

Car Purchase Tax Deduction For Personal Vehicles Otacademy

Private Party Sales Do I Need To Pay Taxes On Person To

Private Party Sales Do I Need To Pay Taxes On Person To

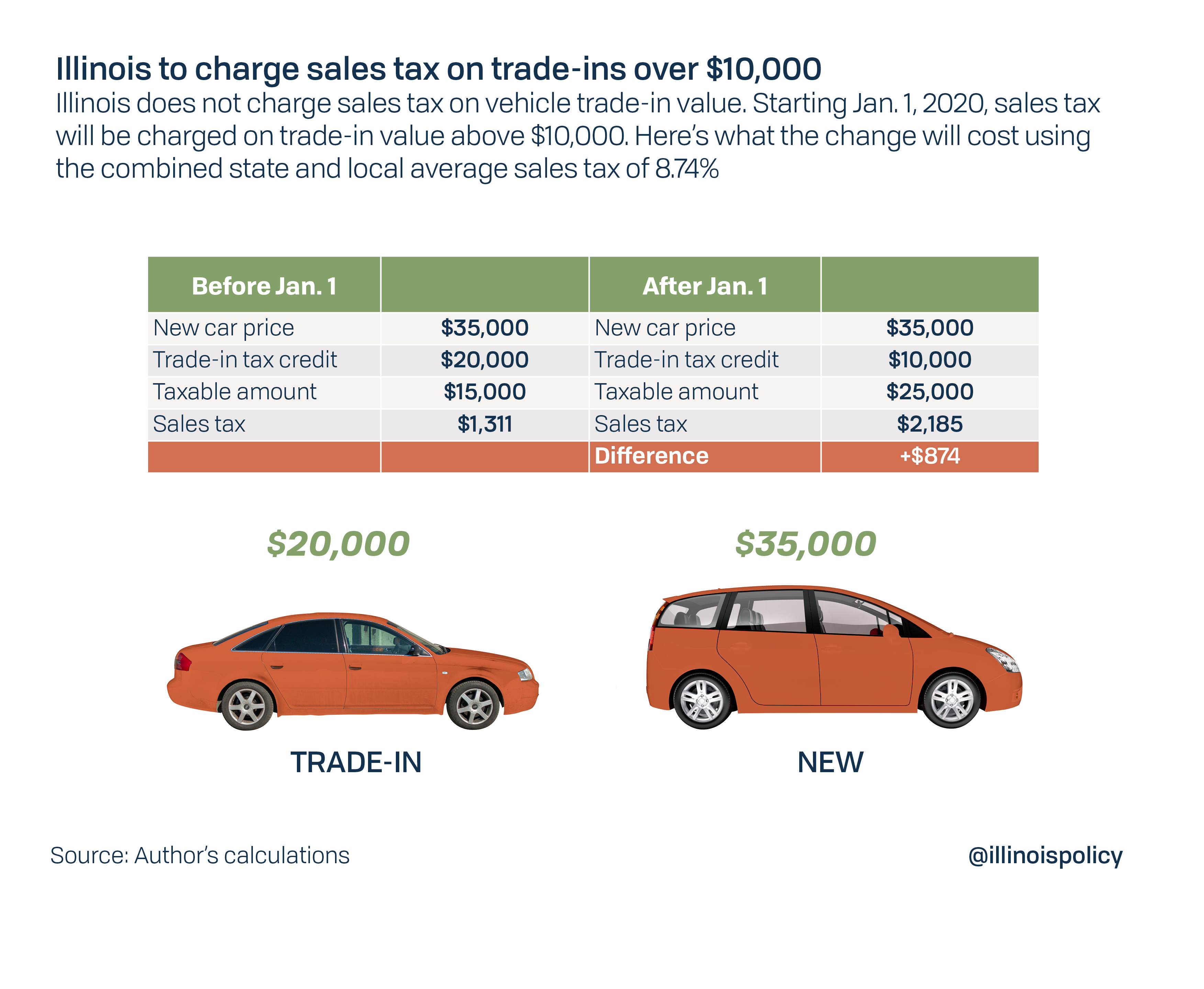

Illinois House Bills Would Reverse Pritzker S Car Trade In Tax

Illinois House Bills Would Reverse Pritzker S Car Trade In Tax

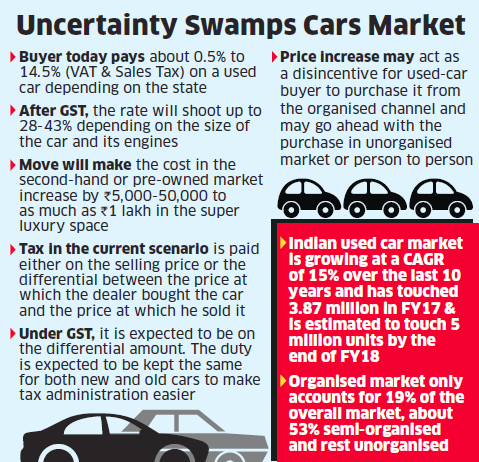

Gst Gst Regime Same Tax Rate On New Used Cars Set To Hit

Gst Gst Regime Same Tax Rate On New Used Cars Set To Hit

China S Car Sales Tax Cut Will Provide Only Temporary Relief

China S Car Sales Tax Cut Will Provide Only Temporary Relief

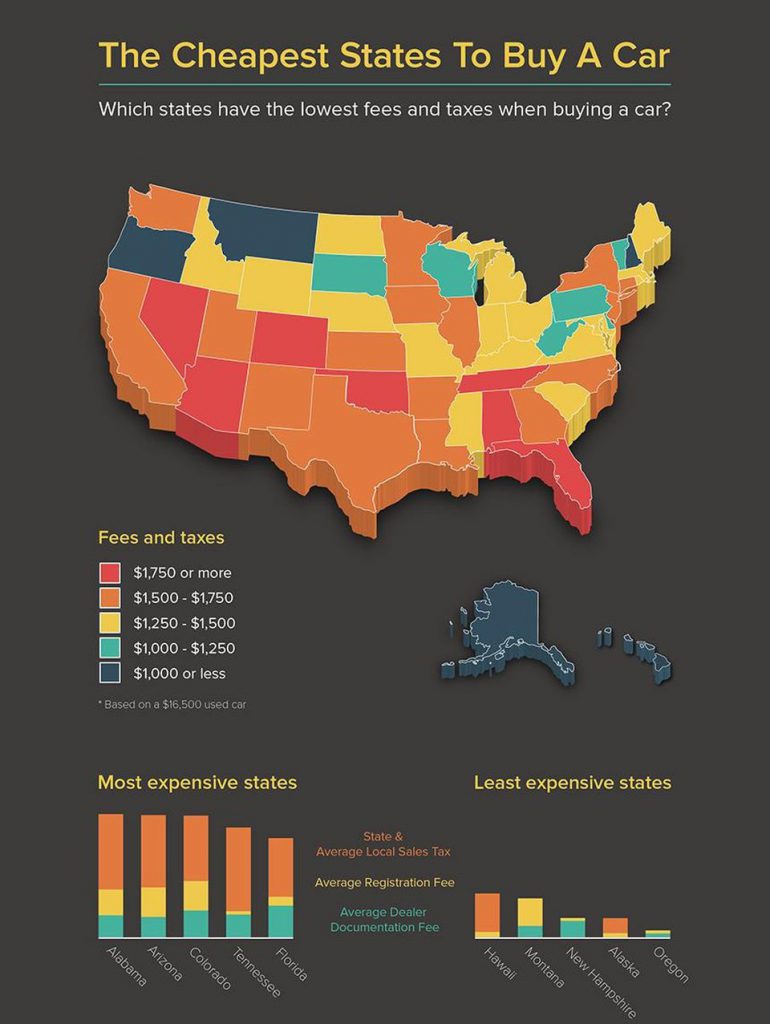

How A State S Tax Laws Can Impact The Cost Of Your Car Lease

How A State S Tax Laws Can Impact The Cost Of Your Car Lease

Buy A Used Car With Your Tax Refund

Buy A Used Car With Your Tax Refund

Smaller Tax Refunds In 2019 Could Slash U S Auto Sales Axios

Smaller Tax Refunds In 2019 Could Slash U S Auto Sales Axios